“If you’re going to negotiate, you’ve got to have something to offer. We don’t.”

I have avoided posting my thoughts about the recent protests in Wisconsin, because my personal reaction has been so visceral that I did not think I could do the topic justice. However, my recent post on The New York Times website has been generating so much traffic to my website, that it is impossible now for me to ignore it. So here goes nothing…

Every private company and public service that has been touched by unions has underperformed.

The airline industry is a disaster. American automobiles have ceased being competitive years ago, not because of bad “marketing”, but because America auto companies build inferior products. They build inferior products because much of the cost to produce these vehicles goes to support lavish union health benefits.

The reason American companies are off-shoring the labor force is that unions have priced their members out of the market.

Then there are the public unions. They organize together to elect politicians, who feed a never-ending cycle of support for pension and health benefits that have gone the way of the dinosaur in the private sector.

Public sector unions have gone far off the reservation. The following three examples from an article published last year in The Economist show how public sector unions have 1) rigged the system in their favor, 2) used tax-exempted union dues to fund the Democratic party, and 3) grown increasingly powerful in number to the point that seven state pensions are likely to go bankrupt by 2020.

Guarding Criminals; Raiding the Treasury

Take the California Correctional Peace Officers Association (CCPOA). In 2006, the average CCPOA union member made $70,000 a year, and more than $100,000 with overtime. They can also retire with 90 percent of their salaries as early as age fifty. The group’s lobbying resulted in a massive expansion in the number of California prisons. So much so, that 11 percent of California’s budget now supports the state’s penal system.

Buying the Boss

The American Federation of State, County and Municipal Employees (AFSCME) accounts for a whopping 30% of spending from pro-Democratic groups. According to the US News and World Report, Big Labor spent more private cash ($171.5 million) in the mid-terms than the Chamber of Commerce and American Crossroads combined ($140 million).

What is more concerning is that these donations come from labor dues. Since labor dues are deducted from union workers’ government salaries, they are not taxed. In essence, every time Big Labor donates to the Democratic Party, all tax payers do.

Budget Deficits and Public Sector Unions Go Hand in Hand

State budget deficits are spiraling out of control because unions have had their hands in the public trough for far too long. Our services and schools are worse tha ever, yet they cost more than ever.

Daniel DiSalvo has noted that in 2009, there were 7.9 million public sector members in unions versus 7.4 million in the private sector. One Northwestern University professor has argued that the situation is so bad that seven state pension funds will go bankrupt by 2020 including: Connecticut, Indiana, New Jersey, Hawaii, Louisiana, Oklahoma, and Illinois.

State Union Membership Inversely Correlated with Economic Health

By several important indicators, the percentage of employees that unions represent in a state is inversely correlated with economic health. The top twenty states with the highest rates of employees with union representation on average have high tax burdens, higher unemployment, higher per capita debt, and lower real GDP growth rates. They also voted disproportionately for Democrats in the last two United States Presidential elections.

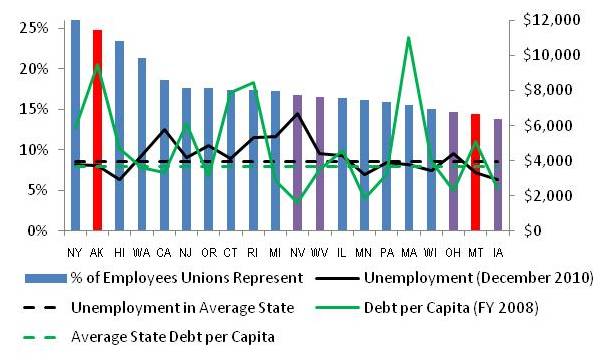

The following chart shows these top twenty unionized states by the percentage of employees in that state that unions represent, the average debt per capita by state, and each state’s unemployment rate. Blue and red states represent those states that voted Democratic or Republican, respectively, in both the 2004 and 2008 Presidential elections. Purple states are those states that voted for a Democratic candidate in 2004 and a Republican candidate in 2008, or vice versa.

Top Twenty Unionized States Vote Disproportionately Democratic

Fourteen of the top twenty most unionized states voted consistently for Democratic Presidents in 2004 and 2008. Of the four states that switched their votes in 2008, three of them switched from a Republican to a Democratic ticket.

Unemployment Higher in Unionized States

The average state unemployment rate for these twenty states is 9.2 percent, while the average state among all fifty states has an unemployment rate of 8.5 percent. National unemployment is higher at 9.4 percent because states with large populations like California that have unemployment rates of 12.5 percent raise the national average.

Debt per Capita Higher in Unionized States

The average state debt per capita for the top twenty unionized states is $4,753 versus the overall average state debt per capita of $3,660.

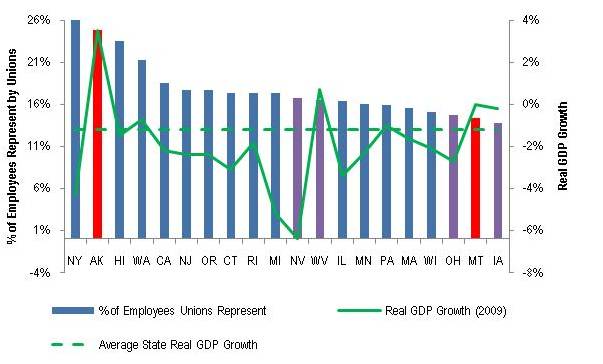

GDP Growth Lower in Heavily Unionized States; Tax Burden Higher

As the chart below shows, the average state’s GDP growth rate was -1.2% in 2009 versus an average of -2.0% among the top twenty unionized states. According to the Tax Foundation’s 2010 State Business Climate Tax Index, eight of these twenty states are in the bottom ten, and thirteen are in the bottom half. Five of these twenty states occupy the bottom five positions on the Tax Index and include from worst to best: New Jersey, New York, California, Ohio, and Iowa.

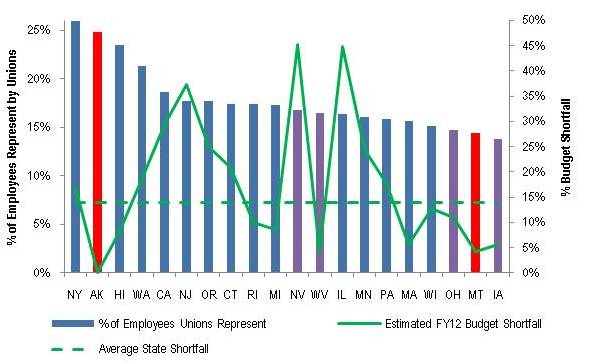

Unionized States Have Higher Projected Budget Shortfalls

The chart below shows the percentage of projected state budget shortfalls versus the percentage of the workforce represented by unions. Again, the top twenty unionized states have an average estimated budget shortfall of 17.5% versus the average state’s projected shortfall of 14.0%.

To be fair, these statistics are a snapshot in history. A more thorough analysis would look at trends over longer time periods. That said, I do not think the end result would change.

The implications of this analysis make intuitive sense. Rent-seeking by unions, particularly in the public sector, result in higher costs for the state. In turn, the state must raise taxes and assume more debt to finance union rent-seeking. These states also have the highest projected budget shortfalls. Because of high taxes and a heavily unionized labor force, it is no surprise that real GDP growth tends to be lower in heavily unionized states.

Another point is worth mentioning. Because politicians are the public sector’s equivalent of private sector management, unions fund candidates who will most likely support union rent-seeking. Hence, high Democratic representation in heavily unionized states.

The bottom line is that unions are bad for business and government. It is time someone took a stand against them.

Bravo, Governor Walker, for taking up this noble fight against the last vestiges of the red menace.

Chart Sources

-

State presidential election data: The Economist

-

Percentage of state workforce with union representation: U.S. Department of Labor

-

State unemployment rates as of December 2010: U.S. Department of Labor

-

State real GDP growth in 2009: U.S. Bureau of Economic Analysis

-

Estimated fiscal year 2012 state budget shortfalls: Center on Budget and Policy Priorities

-

State business climate tax index in 2010: The Tax Foundation

[They build inferior products because much of the cost to produce these vehicles goes to support lavish union health benefits.]

That’s a pretty irrational statement, but then, “rational conservative” is an oxymoron. You’re a regular moron.

Ben,

Thank you for taking the time to read my blog.

To your first point, the statement is not irrational. It is true. GM says that healthcare costs add between $1,500 and $2,000 to the sticker price of every automobile it makes. (See the following backgrounder from the Council on Foreign Relations)

To your second point, please take you ad hominen argumentation elsewhere. It would be “irrational” me to respond in kind.

Well said! it seems Governor Walker has a pair,lets hope he doesnt back down as the media rushes to the defense of thier union boss buddies.

Thanks, Gordon!

It is about time someone stood up to organizations that harm American economic competitiveness before they bankrupt us all.

[It is true. GM says that healthcare costs add between $1,500 and $2,000 to the sticker price of every automobile it makes.]

That may be true, but that’s no excuse for making crap.

It is not an excuse, but it does imply that the Japanese and the Koreans have at least a $1,500-2,000 cost advantage over unionized U.S. auto companies. With that cost advantage, they can afford to make better cars.

Not hardly. They made crap because of their business structure, not because they had to pay benefits.

Their “business structure” as you call it, has an excessively high labor component. Instead of paying for high quality materials or engineers, they had to pay a low-skilled labor force disproportionate wages relative to their competitors.

This is business 101.

Now you’re just making crap up, which is what you right-wingers do, since you don’t have facts on your side.

Ben,

I have carefully sourced everything I say. You haven’t sourced or explained a single one of your assertions or ad hominem.

The facts ARE on my side. They are in my article, they are in the news, they are in company public filings. You are making blanket assertions without any objective support or facts. Here is an example:

“They made crap because of their business structure, not because they had to pay benefits.”

Prove it.

I just don’t know what else to say. It is like talking to a wall.

[I have carefully sourced everything I say. ]

No you haven’t. Where is the source for them not being able to afford to hire highly skilled engineers?

A few facts:

In 2007, GM’s CEO received compensation worth $15.7 million. They can afford to pay the CEO $15.7 million but can’t afford to hire good engineers?

GM’s business structure is what screwed them. They make most of their money off parts — not the sale of the vehicle. For that reason, they’re motivated to make cars that break down and need parts replaced. They’re actually engineered to break down. A Chevy or Ford usually sell for several thousands of dollars less than their Japanese counterparts. They’re trying to appeal to bargain hunters rather than to people who want quality.

And compare the structure of GM to say Honda. Honda is the brand for their regular line of cars and then they have Acura for their luxury line. Nissan has Infinity and Toyota has Lexus, so the Japanese manufacturers are all structured the same. GM, on the other hand, has Chevrolet, Pontiac, Oldsmobile, Buick, Cadillac, GMC, GEO, and they also aquired SAAB and HUMMER, and Opel. (There may be a few that I’m missing.) They’ve gotten rid of a few of those brands in recent years to restructure, but it’s a poor way to run an automobile company. They’ve been in it just for short term gains rather than building innovative and high quality cars.

Ben,

Here is the logic behind my argument that labor costs detract from GM’s ability to pay for other things like highly skilled engineers. I compared data from Toyota’s FY2008 annual report (which ends in March 2008) with data from GM’s 2007 annual report and subtracted the 1Q07 numbers and added 1Q08 numbers so that I am comparing apples to apples (i.e., the period from March 2007 to March 2008). The labor component of an automaker’s sales is included in its cost of goods sold, because they labor content directly produces the car (i.e., direct labor content). Legal, management, and engineering are included in an auto company’s SG&A.

With that in mind, let’s compare the two.

Automotive costs (which include direct labor content) made up a whopping 93.2% of GM’s automobile sales, while it only made up 82.4% of Toyota’s.

Because Toyota had excess capital, it was able to spend 9.5% of its total revenue on SG&A (which includes highly skilled engineers), while GM only paid 8.2%. Keep in mind that total revenue includes both automotive revenue + financial revenue. To your point, the SG&A GM paid also includes some portion of the $15.7 million you cited above, so the company had even less money to pay its engineers than Toyota.

I hope that settles the first point.

Again, the facts clearly support my case.

I was intrigued by the following statement:

“GM’s business structure is what screwed them. They make most of their money off parts — not the sale of the vehicle. For that reason, they’re motivated to make cars that break down and need parts replaced. They’re actually engineered to break down.”

Really???

Do you actually believe that a Fortune 500 company would deliberately conspire to make inferior vehicles, when its name and reputation are at stake? Not to mention the safety issues and potential exposure to legal liability.

Again.

Prove it.

[Because Toyota had excess capital, it was able to spend 9.5% of its total revenue on SG&A (which includes highly skilled engineers),]

No it doesn’t. Do you even know what SG&A stands for?

Ben,

There you go again. Blanket assertion with a continued failure to support your points with facts or data.

I have made my point with facts to the support my argument from GM’s annual report and filings and Toyota’s 2008 annual report, but your retort has not. If logic, reason, and data do not persuade you, then nothing will.

SG&A does not include salaries for highly skilled engineers? Really???

Kiddies, it’s now time for a Sesame Street moment for Ben. The word of the day is “SG&A.” SG&A stands for Selling, General, and Administrative expenses. Selling, General, and Administrative expenses include salaries for employees. Anyone who’s spent a month in business knows that.

And then you still haven’t proven your other blanket assertion:

“GM’s business structure is what screwed them. They make most of their money off parts — not the sale of the vehicle. For that reason, they’re motivated to make cars that break down and need parts replaced. They’re actually engineered to break down.”

I’m still waiting for that.

You’re going to flunk out of college. Engineering is generally included in production costs.

That is correct. The only exception is engineer salaries, which is paid out of SG&A and which is the contention of your argument.

You can try to delay and misdirect all you want, but it won’t get you anywhere with me. Speaking of misdirection, you still have failed to prove the following assertion, which is leading me to believe that you just made it up.

“GM’s business structure is what screwed them. They make most of their money off parts — not the sale of the vehicle. For that reason, they’re motivated to make cars that break down and need parts replaced. They’re actually engineered to break down.”

For the third time, prove it.

You have yet to prove that they couldn’t afford to hire good engineers. That’s a ridiculous assumption and has no basis in fact. They were able to pay the CEO 16 million dollars but couldn’t afford to hire competent engineers? You’re insane. Or just a right-wing sheep.

As far as them making most of their money off parts, just google it.

Ben,

First of all, nice try in attempting to reframe what I actually said. You are increasing the burden of proof by making what I said sound more extreme.

Typical.

I said, “labor costs detract from GM’s ability to pay for other things like highly skilled engineers.” Note the language, “ability to pay.” My argument that GM has a lower ability to pay for highly skilled engineers does not imply that GM can hire no good engineers whatsoever. It merely implies that it had fewer dollars per dollar of revenue to do so, and therefore could hire fewer good engineers per revenue dollar than the Japanese could.

Yet, you distorted my argument by saying that I said, “they couldn’t afford to hire good engineers.”

Nice try. Distort my argument in such a why that the burden of proof is higher and then claim victory. This technique may work well with the proletariat you so glorify, Ben, but it won’t work on me.

I have proven conclusively that GM had fewer dollars per share of revenue to hire engineers, let alone any other top talent than their largest Japanese competitor did. GM’s choice to pay a high salary for their CEO only adds to my point that the company has fewer dollars per unit of sales to pay its engineers than its foreign competitors do (who typically pay their management less than US companies do). Both labor costs and management costs contribute to that fact.

I never said that they didn’t make any money off parts. Again, nice try to deflect my argument.

Of course GM makes money off parts. My contention is with your ludicrous left-wing assertion that GM makes faulty cars so that these cars will break down and force their users to buy more parts. You sound like some left-wing conspiracy theorist looking everywhere for a vast right-wing conspiracy.

Your point is a completely unsubstantiated assertion, with no basis in fact, and one, which you completely made up.

Here is your statement, yet again:

“GM’s business structure is what screwed them. They make most of their money off parts — not the sale of the vehicle. For that reason, they’re motivated to make cars that break down and need parts replaced. They’re actually engineered to break down.”

I’m focused on your ridiculous statement that these cars, are “actually engineered to break down.”

So again, I throw down the gauntlet a fourth time.

Prove it.

Really Ben, this is getting old really fast. You might want to stop before you embarrass yourself any further.

Just because you’ve lost every battle does not mean you are going to win the war.

[I said, “labor costs detract from GM’s ability to pay for other things like highly skilled engineers.” Note the language, “ability to pay.” ]

Good, so you admit your argument doesn’t hold water.

Fact: For many decades, U.S. auto makers used the strategy of planned obsolescence; they were designed to wear out. That strategy only works when there is a monopoly or oligopoly.

Fact: In the late ’70s, Toyota embraced a strategy of building high quality cars with more attention to quality control. The other Japanese manufactures followed and it wasn’t long before they started to overtake the U.S.

Besides continuing the planned obsolescence strategy, U.S. manufacturers also failed to recognize what people wanted. Their designs were obsolete. Most of their cars were rear wheel drive and got crappy gas mileage.

Ben,

I stand by the argument I made from the beginning (“labor costs detract from GM’s ability to pay for other things like highly skilled engineers.” Note the language, “ability to pay.” ).

I never argued that “that they couldn’t afford to hire good engineers.”

Again, nice try at distorting my argument.

I would agree that Japanese competition cleaned the clock of US auto companies, but I would appreciate a link or a source to your “Fact” that “For many decades, U.S. auto makers used the strategy of planned obsolescence; they were designed to wear out. That strategy only works when there is a monopoly or oligopoly.”

Even so, US auto companies failed long after introduction of Japanese automobiles in the 1970s, when they no longer had a monopoly or oligopoly. Are you suggesting that despite the demands of new competition, the US auto majors still pursued a policy of “planned obsolescence”?

I find that hard to believe, but if you can provide a credible source (via a link, etc.), I will be happy to accept your argument.

No offense, but I cannot accept a “Fact” based solely on your say-so.

[I never argued that “that they couldn’t afford to hire good engineers.”]

Your entire argument is based on the assumption that U.S. manufacturers can’t compete because U.S. manufacturers don’t have as much money to spend on good engineers. Without that, you have no argument to defend the auto makers.

[No offense, but I cannot accept a “Fact” based solely on your say-so.]

Good. Do some research. I read it several years ago, probably in that liberal rag the N.Y. Times.

Ben,

There you go again. You are taking one small component of my argument and conflating it to be the sole basis of my contention.

My entire argument is not based on the assumption that “U.S. manufacturers can’t compete because U.S. manufacturers don’t have as much money to spend on good engineers.”

My argument is that they have less money to spend on things outside of labor to make good cars because their labor costs are too high. This bleeds into everything from investing in research and development, to buying higher quality materials, to attracting and retaining the best engineers. These are merely examples of where money does not go as a result of the high component of union labor in U.S. auto companies. As a result, American auto companies make inferior cars.

On your last point, the burden of proof is still on you, my friend. But if you find it in the New York Times, that will be good enough for me. 😉

while I agree with much of what you have written, I cant go along with the statement “The reason American companies are off-shoring the labor force is that unions have priced their members out of the market.” It’s hard for anyone to ‘compete’ with a developing country in terms of labor costs.I mean, if Jose will put that bolt in the car foe 2.50% an hour, how can it remain ‘competitive’? That’s not the fault of the Union alone.

oops some spelling errors there: sorry 2.50$ and hour;-)

Elf,

Your point is a fair. I would certainly agree that it is not the only reason, but it is definitely a contributor.

Hi Sean –

Thanks for an objective analysis. I am a Dem and like to rational analysis based on data points. I agree that public union can sometimes lead to the creation of a bourgeois class that is equally subservient to its constituents and takes away from progressive goals such as education and health care. Having said that, I am find a couple of flaws in your assertion that labor unions are dragging down the American economy:

1. Labor unions have been around in this country for nearly a century. During this time America has seen some of most productive years, rapid growth in prosperity and a solid middle class. How do you explain the paradox ? If labor unions are bad, they must have inhibited and destroyed this country by now.

2, Germany has some of the largest unions in the world. Heck, even their managerial class is organized under Works Council and shares important board positions and are a participant in strategic decision making. Yet Germany is one of the most successful industrialized nation and maintains a strong manufacturing base despite high wages. How do you explain that ?

3. If unions are busted, who is going to defend the middle class and the poorer section of the society. Already most middle class jobs in this country has shipped by an elite that is sharply focused on quarterly earnings and EPS numbers. Doesn’t this tunnel visioned goal mis-align with the goals of a healthy society ? Perpetually chasing this one metric means that everyone is disposable – human labor is just a resource, an item in the balance sheet, to be disposed off at any moment. Don’t we as middle class citizens need representation to protect us from an overriding goal that is contrary to the well being of us ?

4. The pro-union states that you point out that have supposedly marginally higher unemployment that non-union states – isn’t that purely a correlation without causation? Weren’t there are other factors (huge real estate bust in CA and auto industry in Michigan) account for that ? Can you also publish charts such as the SAT scores by pro-union and non-union states, ranking of public universities, availability of parks and recreational areas, teenage pregnancies, type of jobs created etc. .

Dip,

Thanks for taking the time to read and comment on my blog.

To your first point, there is no doubt that unions helped secure useful benefits for workers earlier in the century. However, I think in the last 30 or 40 years, unions have outlived their usefulness and have now become a self-perpetuating machine that no longer makes sense in today’s rapidly evolving and highly competitive economy.

To your second point, the reason Germany has been successful is because of their Mittelstand model in which small German firms focus on highly specialized and technical niches. Most German unions are for highly skilled workers as opposed to American labor, which is mostly unskilled. The Germans are able to sustain higher relative wages because they operate in highly skilled niches where the market is willing to pay a premium. That said, until recently, the German economy, as well as Europe in general, tends to have persistently longer trends of unemployment after a recession than the United States does. Germany was able to recover much quicker than the United States this time around because, it was not caught up in the property bubble (there is a great article in the Economist magazine about this earlier this month or late last month that explains this view in more detail).

To your third point, you are correct. There is definitely an imbalance between both extremes in this country and no one seems to represent the middle. I think elected politicians need to do a much better job of representing the middle class as opposed to kow-towing to corporate fat cats and union thugs. I think the solution involves redrawing districts to reflect more balance, rather than exacerbating partisanship. I think we can get along fine without unions. They are part of the problem, just as much as corporate interests sometimes can be.

To your fourth point, the results of each state’s economic system are certainly the result of a complex interaction of variables, one of which is high unionization. State-specific sector declines and property bubbles certainly have impacted these statistics as well. But keep in mind, states like Arizona and Florida, which have massive property bubbles are included in the averages for all 50 states. I don’t understand the relevance high SAT scores to state unionization rates. Wouldn’t that be more a function of demographics (e.g., income, parent’s education, race, etc.)?

At the end of the day, both ends are playing against the middle here and something must be done to fight the extremes.

Sean,

I am not convinced by the Germany argument. The last decade has proved that there is nothing niche that can be protected. Remember, computer programming ? Once thought about as a specialized skill has been rapidly commoditized and sent offshore to Bangalore. You can hire a programmer in India for $10 an hour and build a complex software. Even complex engineering products such as micro chips, aircraft software, defense systems are being outsourced. There is no reason that auto part manufacturers cannot be shipped to China. So why aren’t they ? I would like to argue that two factors that explain a lot behind this:

1. Corporate culture: I consult on organization culture and got my MBA from an IVY league school and have studied this in detail. The US corporate culture is in a deadly spiral of cutting costs on perpetual basis. I have never done a project where I wasn’t asked to reduce cost and “leverage” offshore to manage work. During my consulting career I have seen this zeal of moving “non strategic” work to an offshore location unabated. There was never any objection on hiring a “resource” from China/India but hiring someone in the US one needs to create a business case for that. This pervasive persuasion of cost reduction is driven primarily by shareholders, dominated by activist investors, looking for a short term return on equity that beats the market. The German model consists of a mix of public-private partnerships and many German companies are not even publicly traded. To this end, these companies do not suffer from the constant need to pad EPS every quarter. Unfortunately, the way markets are set up in the US, this trend is unlikely to be curtailed

2. Compensation committees: Executive pay in the US is rigged. Plain and simple. Compensation committees are composed of friends and buddies of the executive branch in any organization and they scratch each other’s back. The result is the massive gap between what executive pay and average pay within the organization. The US middle-earner real wages has largely been unchanged since 1980s while executive compensation has ballooned – so much so we have an entire industry dedicated to computing exec. comp. This is a huge disconnect and reflects a organizational culture that is mis-aligned with the benefits of the society. I worked in Netherlands for many years. The executive pay gap does not exist there. Most people work 35 hr works weeks and get 2 months of vacation time. Add to it generous benefits and free healthcare. Conventional wisdom would suggest that Netherlands would have to give it all up or be destroyed by emerging markets, however the unemployment rate there was around 4-5% throughout the recession. The reason I bring this up is to refute the popular argument that the middle class needs to give up more and more to compete in the global markets. Yet, this is not true in many of the industrialized nations in the world due to a complex set of variables. We have been forced to believe by constant media propaganda that our quality of life is unsustainable. Therefore the middle class in the US has been signed up for a race to the bottom, to compete with $2/hr labor pool. However, this need not be the case as demonstrated by many industrialized nations.

3. There are no “American” companies – In essence they are so globalized, American corporations do not own allegiance to the United States. They have successfully disconnected from the society that nurtured and enabled corporations to thrive. This is actually very different from what is happening in the rest of the world. My parents grew up in India, and I know many of the Indian corporations are closely integrated with the society. Infosys has been instrumental in bringing social change in India, supports grass root education, women empowerment and closely partners with the Indian government. Tata’s – a big conglomerate – has a long history of closely partnering with the government to participate in social changes. My point is, in a capitalistic society, I am fine with the American corporations detaching themselves from the society. But why would the middle class fight a mechanism, that at least in theory, protects their interests aka the unions ? If American jobs are a number on the balance sheet, that constantly need to be reduced, shouldn’t philosophically we support a mechanism to protect it, however flawed it is ? Why are we all participating in the race to the bottom ?

P.S.: Apologize for incoherence in my language, really hard to type up between work, travel and hotel stays.

Dip,

All great and interesting points.

I disagree that everything can be outsourced. Because many German Mittelstand firms operate in very narrow niches and required extremely skilled workers, there are barriers to entry to 1) training folks elsewhere and 2) purchases the equipment to do the same activity elsewhere. Think of precision machine tooling operations, as a random example. It is much more expensive to move that they say training a kid to program. Additionally, Mittelstand firms are much smaller than their American counterparts and in many cases it would not make sense to outsource them because of their lower economies of scale.

That said, your argument that US corporate culture is too focused on quarterly earnings is probably also a factor in the German middle classes ability to keep high-skilled labor jobs. As in most things, there are a lot of variables that drive these trends.

Your point on #2, I think is also a fair one. CEO’s stack boards with their friends much like public unions donate money to their friends. It is almost the mirror image of what is currently going on with public unions, only CEO’s get paid a heck of a lot more.

Your point on #3, I think is an interesting one. I think you are right in your assessment that most large American companies have gone multinational is correct. I think the drivers for this are low labor costs overseas and higher relative corporate taxes. I think that may also be another reason why Germany has retained more jobs in Germany.

The obvious way for the United States to lure these companies back would be for it to lower the corporate tax rate so it is more comparable with countries like Germany.

I personally also don’t think unions represent the middle class. This is just an opinion. I may be a little off with this number, but they only represent something like 6.9% of private employees and something on the order of 30-40% of public employees. I agree that in many cases, the middle class’ interests are not being well-represented. That said, I also don’t think unions are the answer. I think they served their purpose decades ago, but have now become fat and calcified. Now they seem to exist solely as a means of perpetuating themselves.

Of private and public unions, public unions are far more problematic because they can help elect their own “management,” which can cause a positive feedback cycle that risks drain state treasuries. I am worried more about them than private unions.

Pingback: Heavily Unionized States | AllGraphicsOnline.com